Housing prices can stop rising without becoming affordable, and Las Vegas is the best example of this. While rapid price appreciation has stopped, it does not directly translate into relief for renters and homebuyers.

Las Vegas Housing Prices Far Outpace the Nation

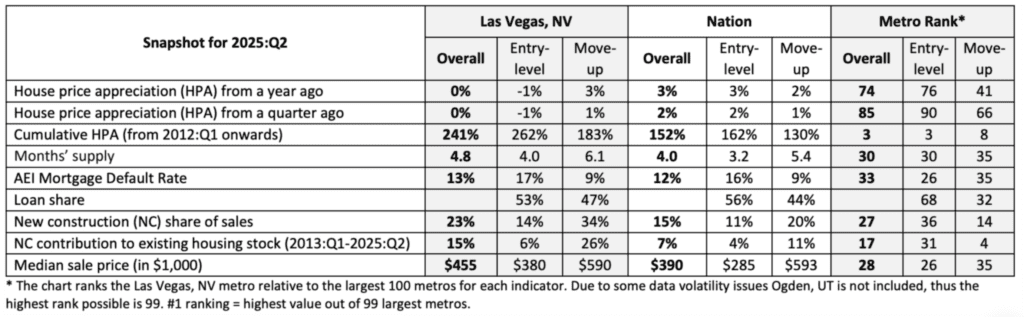

Currently, Las Vegas Metro prices are up 241% from 2012, a significant difference from the national 152% increase. Consequently, Las Vegas ranks third in the nation’s biggest metro areas for Housing Price Appreciation (HPA). Although reflective of the valley’s desirable location and benefits, the growth has far outpaced wage gains. And while there is new construction that is contributing to the market to increase the housing supply and meet the buyers’ demand, the costs are not dramatically decreasing.

What the Case-Shiller Index Shows About Long-Term Trends

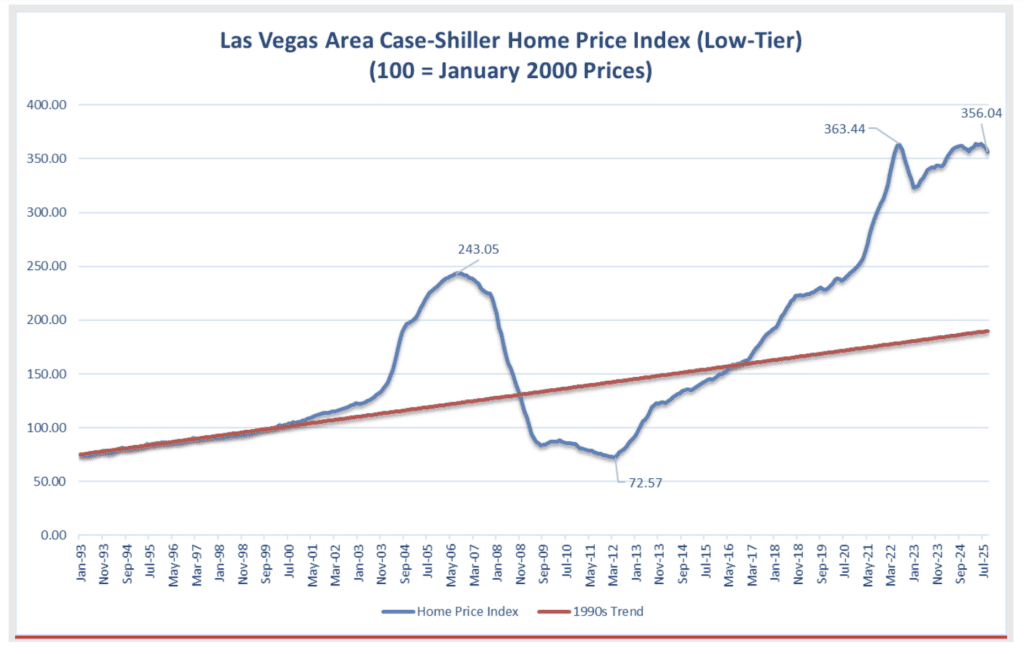

For a big picture view, it is helpful to compare the current Case-Schiller Home Price Index to the trendline from the 1990s. (The Case-Schiller compares the sale and re-sale of the exact same house over time, so it provides a consistent and reliable view of long-term price appreciation.)

Las Vegas was the epicenter of the housing bubble from 2006-2008. However, comparing the two trendlines, it becomes clear that following the great recession, prices have grown way past the long-term trend.

How Monetary Policy Fueled Housing Inflation

Monetary policy played a heavy hand in these fluctuations. Initially, artificially cheap credit drove the buying frenzy in the early 2000s. Demand grew, so did the prices, and that needed a correction. Later, between March 2020 and November 2021, the Federal Reserve roughly doubled the monetary base, prompting another asset inflation round, which of course applied to housing.

Concurrently, remote work gained unprecedented popularity, putting Nevada on the map as a desirable destination for workers who did not need to be attached to cities such as Los Angeles or San Francisco. So, while there has been a push on the demand-side of the market, supply constraints have prevented the appropriate adjustments.

Supply Can’t Keep Up With Demand

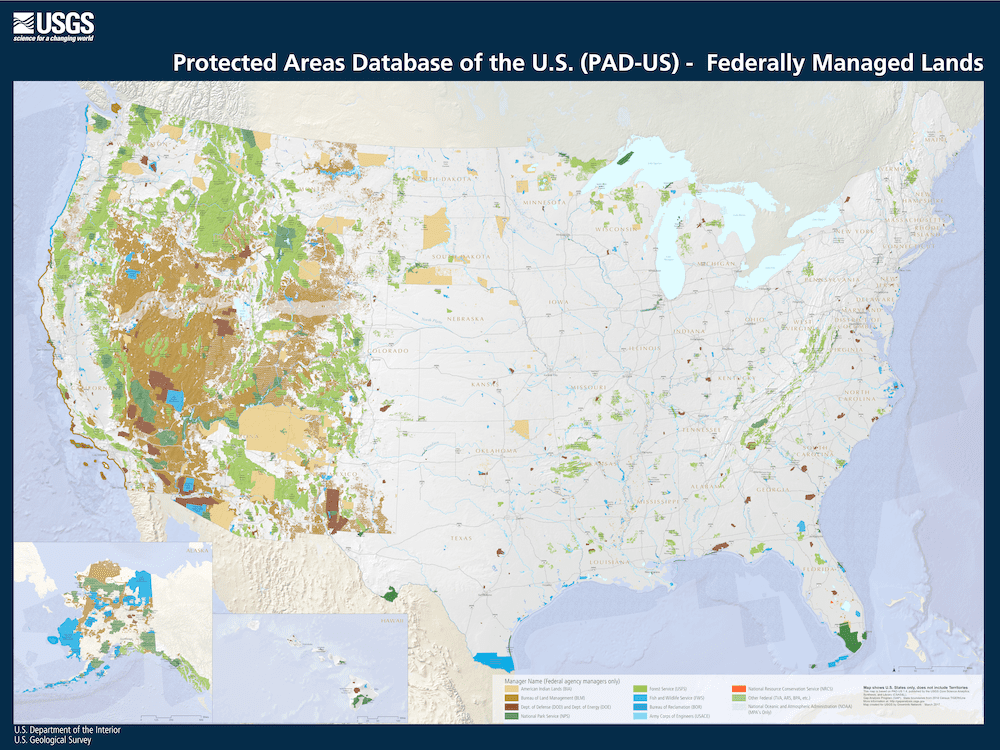

One major reason behind the existing dynamic and policymakers’ concerns is the limited availability of land. 86% of the land in the state of Nevada is owned by the federal government: more than any other state in the union.

This means that all the metro areas in the state, not just Clark County, are significantly limited in the expansion and growth that they can plan. Unlike most states where population growth and lack of housing supply can be mitigated by expanding outward, Las Vegas is engulfed in a sea of federal land. The housing statistics above reinforce this reality – while new construction accounts for a sizeable share of entry-market sales, it does not meaningfully lower the general prices because land availability is heavily restricted.

Federal land ownership is not an issue for future development only. Currently, in Southern Nevada, developers must undergo a competitive bidding process to secure a desirable land parcel (profits of which are invested in purchasing more land by BLM, but that is a different layer of the issue). The costs of acquiring and developing the federally owned land are then passed down to the buyers. In this case scenario, even well-intentioned expansion and construction can be costly for the buyers.

Why the Housing Market Can’t Self-Correct

Ultimately, the heavy share of land ownership by the federal government is putting restraints on economic development and urban growth, artificially inflating the market prices. Addressing this issue, hence, should be the utmost priority for Nevadans. Without reforms that acknowledge the urgent need for growth and position Nevada as an equal to other states, every solution will be a short-term band-aid.

A stabilized but constrained market cannot correct itself. Especially not when the land around it is off-limits.

Stay Informed on Nevada Housing Policy and More

Want to stay informed as Nevada’s housing market continues to change? Sign up for our newsletter to get clear, data-driven insights delivered straight to your inbox. We break down what’s happening, why it matters, and what policies are shaping affordability across the state—so you can stay informed without the jargon.