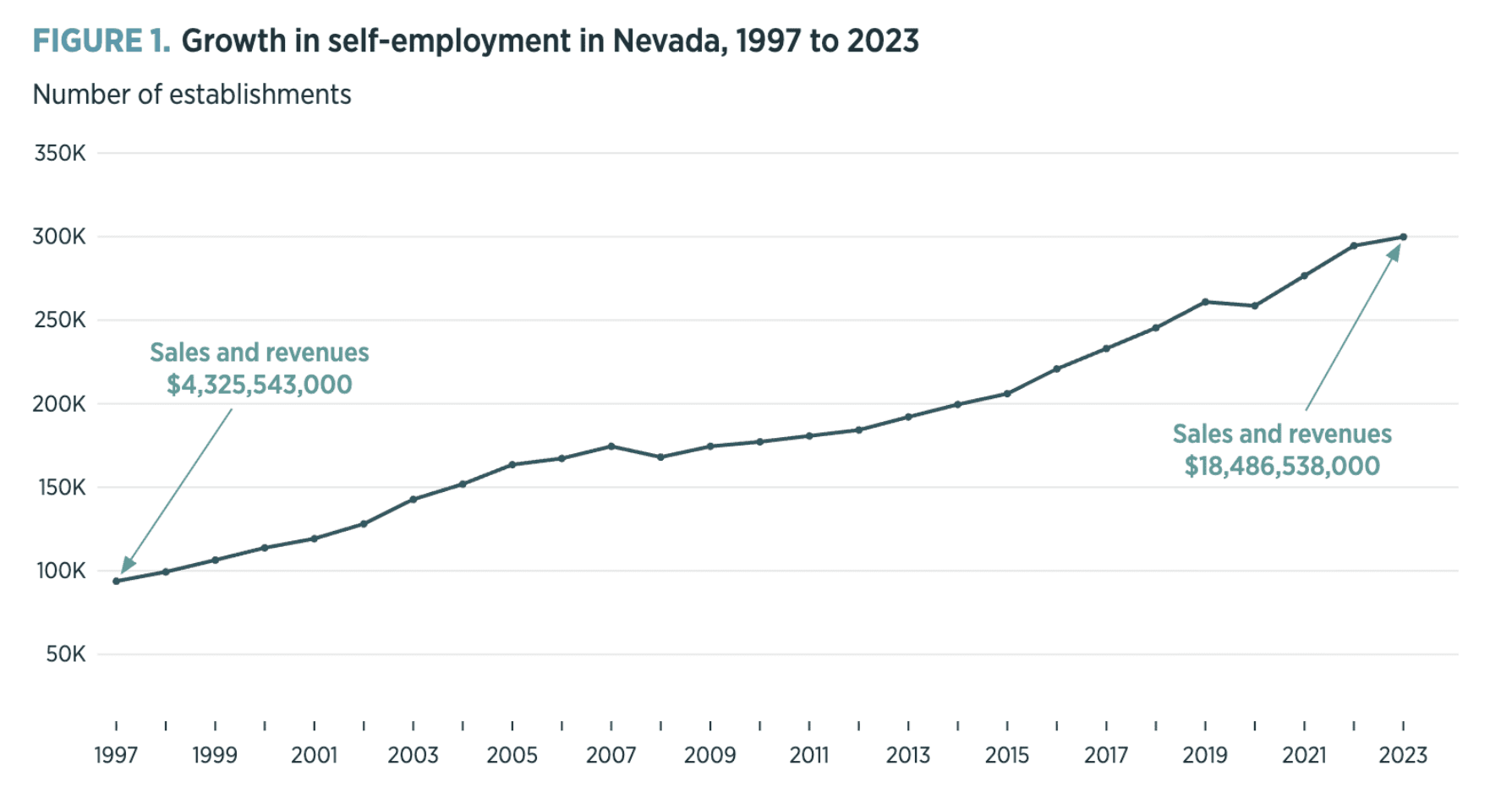

In the past 25 years, the number of independent contractors, freelancers, and self-employed workers has tripled in Nevada, reaching 300,000. One of the key distinctions between full-time employees and independent contractors is accessibility to benefits such as healthcare and life insurance, retirement planning, etc. However, over 80% of self-employed workers would prefer to have access to similar benefits in their employment setting as well.

What Portable Benefits Accounts Are and How They Work

Portable benefit accounts are the emerging policy solution for this growing market. They allow the independent contractor to contribute or receive contributions from their employer into a worker-owned account managed by a third-party that will follow them. The funds from these accounts can be applied to traditional benefits such as insurance premiums, retirement contributions, and more.

A solution like this allows the workers to maintain their employment status and have some degree of autonomy over planning and spending for benefits. Importantly, portable benefits accounts allow individualization that fits the needs of each freelancer – for example, one independent contractor may choose to have all their funds allocated only to health insurance premiums, while another might allocate all their savings to a 401(k) account. Furthermore, the contributions from the employer are optional, meaning that the businesses of the Silver State will not be faced with additional mandates and reporting requirements.

States Leading the Way on Portable Benefits Policies

States like Utah, Georgia, and Pennsylvania have already started implementing this policy for their workforce. Corporate giants like Lyft, DoorDash, and Target have launched their versions of the portable benefits accounts for cab drivers, truckers, and more. The existing programs in Utah and Pennsylvania also demonstrate that there is no significant change in employment nature, meaning that after these policies were implemented there was no spike in the number of 1099 employees or dip in the number of W-2 employees.

Nevada’s Debate Over SB 336 in the 83rd Legislative Session

During the 83rd legislative session, Nevada elected officials debated on the passage of this measure. Some of the common concerns voiced by the legislators in the committee hearings included the lack of reporting to the Labor Commissioner as well as the potential for employers to reclassify all their employees as independent contractors for fiscal planning purposes. Both concerns had similarly been discussed in other states and addressed through amendments or evidence-based approaches. Although the bill ultimately took the shape that all stakeholders wanted, SB 336 passed through the Senate with 19 yes votes and 2 no votes but never reached the Assembly floor.

A Voluntary, Market-Driven Solution for Modern Labor Needs

Labor policies of this nature are binding for neither the employer nor the contractor—participation is voluntary. But it offers a contractual method for companies to retain and incentivize valued service providers while contractors acquire greater stability. Portable benefits are a non-partisan common-sense approach to a growing need in the Nevadan economy and might just be the foundation for a 21st-century workforce model.

Stay Updated With the Latest Research and Insights

Sign up for our email updates to receive more research-driven articles, policy analysis, and timely insights delivered straight to your inbox.