Nevada taxpayers have invested significantly in publicly funded education this century, with calls for increased spending of this manner undergirding the three largest tax hikes in state history, those of 2003, 2009 and 2015. In addition, Gov. Joe Lombardo used a record budget surplus to raise state spending by more than $2,000 per pupil during the 2023 legislative session.

This brief analysis examines key trends in Nevada public education spending, relying on data from annual financial reports compiled by the Nevada Department of Education.

Notes on Data

Recently, Nevada Policy produced a breakdown of trends in Nevada’s public spending on K-12 education during the 21st century based on reports compiled by the federal Department of Education. As noted there, those reports are the only reliable means of comparing information across states because the federal government imposes a uniform process for reporting this information.

Reports on education spending produced by individual states frequently offer much more detailed information about the components of revenues and spending but are not always directly comparable to reports produced in other states.

Still, informative insights can be gleaned from an analysis of annual financial reports compiled by the Nevada Department of Education. The structure of these reports has changed over time with the most significant change being that they did not include spending from all sources until 2011.

For instance, federal grants to school districts were not included in spending totals prior to that year. As a result, the reports from 2001-2010, which Nevada Policy received through a public records request, are not directly comparable to those from 2011-2020 because they understate spending totals. Each decade of this century is therefore analyzed separately where appropriate to ensure consistency.

Total Spending

Total spending by Nevada school districts more than tripled from $1.791 billion in 2001 to $5.606 billion in 2020. Much of this growth occurred in this century’s first decade as spending in 2011 amounted to $3.996 billion. These figures do not account for the record spending increases agreed to by Gov. Lombardo and Nevada lawmakers in 2023.

Overall Employment

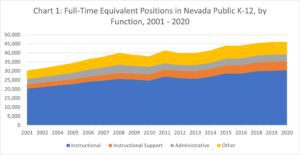

As the state has grown, so too has student enrollment and the demands facing schools. Full enrollment in 2001 amounted to 340,617 students. By 2020, this population grew to 487,260 students, an increase of 43.1 percent.

Employment within Nevada’s school districts grew faster than the student population. In 2001, school districts employed 30,244.5 full-time equivalent, or FTE, positions. By 2020, that figure grew to 47,248 FTE positions – an increase of 56.3 percent.

This growth was concentrated within particular classes of employees:

- The number of “instructional” employees, meaning teachers, grew 50.2 percent;

- The number of “administrative” employees, meaning principals or district-level managers, increased 38.3%; and

- The number of “other” employees, including janitors and maintenance crews, increased 44.3 percent.

The bulk of districts’ growth in employee counts was concentrated among “instructional support” positions, meaning teachers’ assistants and curriculum advisors, which grew 102.9 percent.

Salary Trends

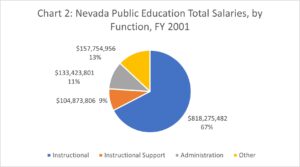

Total spending on salaries for district employees grew much faster than student counts or FTE employee counts. In 2001, total spending on employee salaries amounted to $1.214 billion. By 2020, that figure was $2.700 billion, an increase of 122.3 percent. Charts 2 and 3 display these totals for each year.

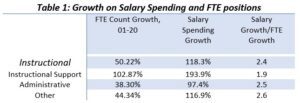

Segmenting this growth by type of employee reveals additional insights. As Table 1 shows, spending on salaries for “instructional support” personnel grew the fastest, as one might expect based on FTE count growth for this group.

However, when considering the growth in payroll as a factor of growth in FTE count, the pay per position grew slowest for this group, even though payrolls still grew nearly twice as fast as the number of positions. For teachers, administrators and “other” positions, payrolls grew around 2.5 times as fast as employee counts.

However, when considering the growth in payroll as a factor of growth in FTE count, the pay per position grew slowest for this group, even though payrolls still grew nearly twice as fast as the number of positions. For teachers, administrators and “other” positions, payrolls grew around 2.5 times as fast as employee counts.

Total Compensation

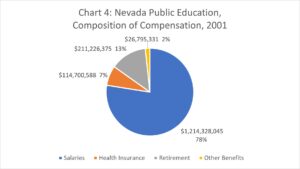

Salaries paid directly to employees are only one component of employee compensation. Government employees in Nevada also receive a comprehensive and valuable set of benefits, including the nation’s most generous retirement perks and a health benefits package more generous than what is commonly available on commercial markets.

According to an actuarial analysis by former deputy commissioner of the Social Security Administration Andrew Biggs, for instance, the average value of annual pension accruals in Nevada is $31,089, significantly higher than the national median for public employees of $9,573.

When reviewing financial records, it’s clear that non-salary compensation to employees is significant for Nevada school districts.

When reviewing financial records, it’s clear that non-salary compensation to employees is significant for Nevada school districts.

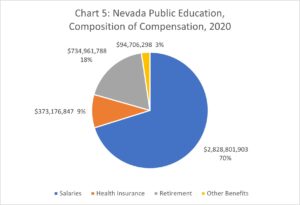

The cost of these benefits has also grown over time. As shown in Charts 4 and 5, salaries accounted for 78 percent of spending on employee compensation in 2001, but that ratio fell to 70 percent by 2020, as the growth in benefits expense outpaced the growth in payroll expense.

Spending on retirement and health care perks more than tripled over this time while spending on salaries merely doubled.

Operational Expense

Operational Expense

A key advantage of state reporting over federal reporting is that operational expenses are highly detailed. Operational expenses of Nevada school districts – spending on things other than employee salaries and benefits – totaled $169 million in 2001, but grew to $1.439 billion by 2020, a growth rate of 741.5 percent over two decades. Clearly, operational expenses grew immensely faster than spending on employee payrolls. Whereas this spending accounted for just 9.5 percent of all spending in 2001, that ratio grew to 26.1 percent of all spending by 2020.

Key line items that contributed to this substantial growth include spending on consultants, software, liability insurance and construction services.

Key line items that contributed to this substantial growth include spending on consultants, software, liability insurance and construction services.

Total spending on “professional services,” including external lawyers and accountants, totaled just $13.2 million in 2001. By 2020, this line item had proliferated into multiple expense categories, reflecting school districts’ hiring of management consultants, curriculum consultants, professional development consultants, marketing firms and a growing army of external lawyers.

By 2020, spending on all these groups amounted to $212.8 million. As an example of this type of spending, the Clark County School District spent roughly $350,000 hiring a consultant in 2014 to describe the personality types of the seven school board members in colors of blue, green, red or yellow.

Spending on software and information technology increased from $1 million in 2001 to $124 million in 2020. Interestingly, by 2011, school districts created a new line item for “non-instructional software,” upon which they now spend about $8.5 million annually.

One might presume these figures reflect a shift away from hard-copy books toward computer software. However, spending on textbooks increased from $16 million in 2001 to $24.6 million in 2020, and actually spiked to $45.5 million in 2021.

Liability insurance jumped from $1.5 million in 2011 to $20.2 million in 2020, a growth of 1,242.6 percent in just the past decade. This reflects a growing belief among insurers that financial claims against Nevada school districts have become far more likely. This may be due to insurers’ assessment that school districts are increasingly reckless or negligent.

Liability insurance jumped from $1.5 million in 2011 to $20.2 million in 2020, a growth of 1,242.6 percent in just the past decade. This reflects a growing belief among insurers that financial claims against Nevada school districts have become far more likely. This may be due to insurers’ assessment that school districts are increasingly reckless or negligent.

Finally, “construction services” accounted for $543.3 million in 2020 despite not even being an expense category in 2001. For clarity, these services are not related to the construction of new school buildings, as accounting standards dictate those costs would be debited to the assets side of a balance sheet rather than expensed. Instead, these services are a form of consulting agreement.

Conclusion

Twenty years of state financial records covering Nevada school districts reveal some insightful trends about taxpayers’ increasing investments into these entities. Spending more than tripled. Employee counts grew faster than student counts, especially among “instructional support” personnel. Retirement and health care benefits grew faster than payrolls.

But operating expenses other than employee compensation consumed a shockingly large share of the growth in spending. Third-party consultants have found a lucrative business in securing contracts from the boards and administrators of Nevada’s school districts. There are no major items of savings in any category of operational expense.

If Nevada taxpayers wish to receive value for the money lawmakers have appropriated toward these entities, greater discipline over operational expense is required.