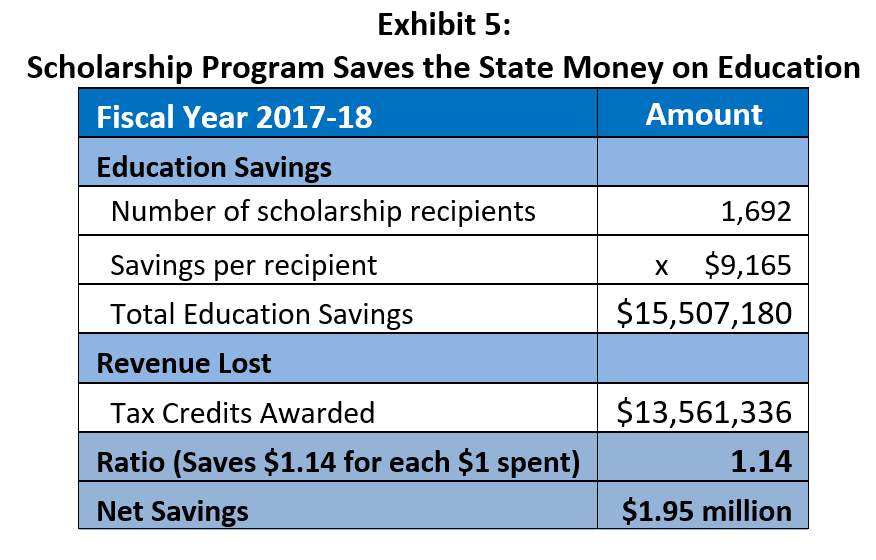

The Nevada Educational Choice Scholarship Program (hereafter the “Opportunity Scholarship” program, as it is more commonly known) produces a net savings to the state. For the current Fiscal Year 2018, we estimate that taxpayers have saved $1.14 in state education funding for every dollar loss in Modified Business Tax (MBT) revenue due to credits for scholarship contributions. We further estimate that, as a greater proportion of approved tax credits are used to finance scholarships, taxpayer savings could increase to $1.92 for every dollar loss in revenue due to tax credits.

Student participation of 1,692 in the scholarship program for the current fiscal year has in effect increased K-12 per-pupil expenditures by about $4, but that number could increase to $27 as additional scholarships are awarded with existing credits. We further assess that expanding student participation to 25,000 (approx. 5% of statewide public school enrollment) could increase per-pupil spending by as much as $235. An increase in per-pupil spending of this magnitude mimics the effects of an additional $116 million in annual education funding.

Similarly, Nevada’s universal Education Savings Accounts program would also generate a net savings to the state, but the program has yet to be funded. Like Opportunity Scholarships, the average value of an ESA would be much less than what the state spends annually on a per-pupil basis, but it is difficult to estimate the fiscal benefits without having access to more information.