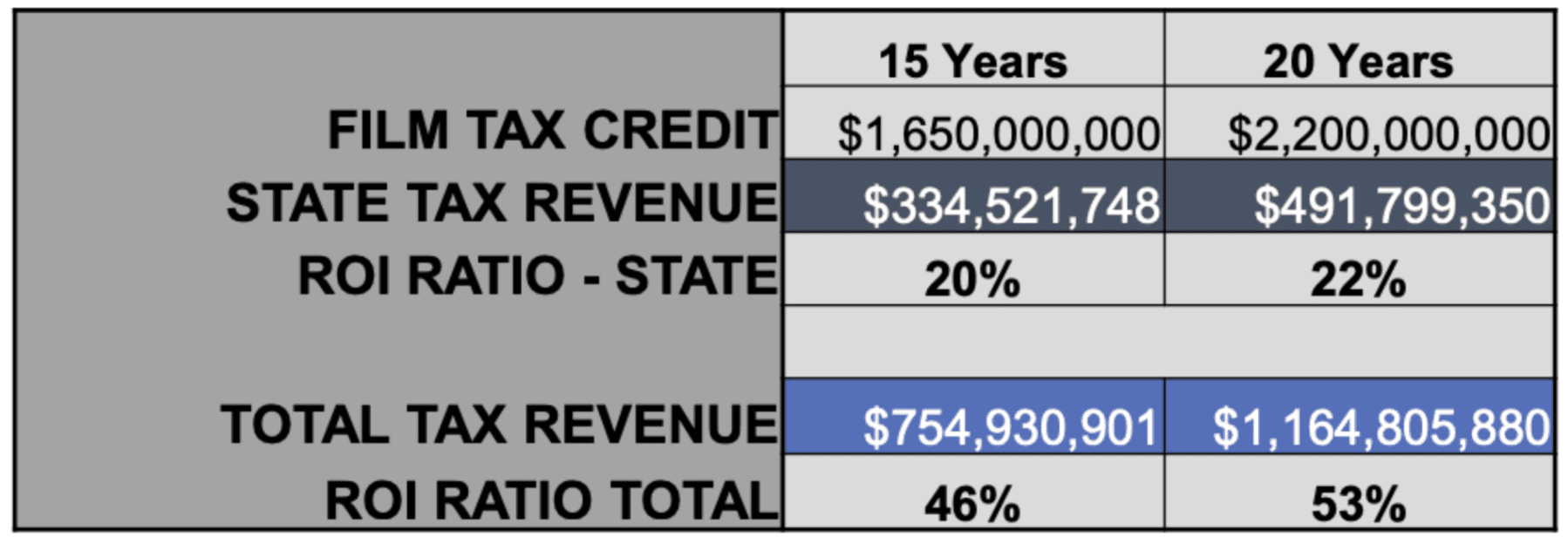

Despite being marketed as major economic boosters, film tax credits consistently produce negative returns. State after state has found that for every dollar invested, taxpayers often get only a few cents back. In Nevada, the economic analysis prepared for bill sponsors themselves showed that for each $1 spent, the state would earn back only $0.20—a net loss of $0.80 per taxpayer dollar.

Nevada’s Costly Sequel

As Governor Lombardo announced an imminent special session later this year, film tax credits are once again taking center stage. The proposal, designed for Hollywood giants Sony and Warner Bros. to open studios in Southern Nevada, was previously voted out of the Assembly by a narrow margin before stalling in the Senate. It would have extended $95 million in annual transferable tax credits for 15 years and created a new district whose tax revenues would fund pre-kindergarten programs in Clark County.

How “Economic Impact” Studies Inflate the Numbers

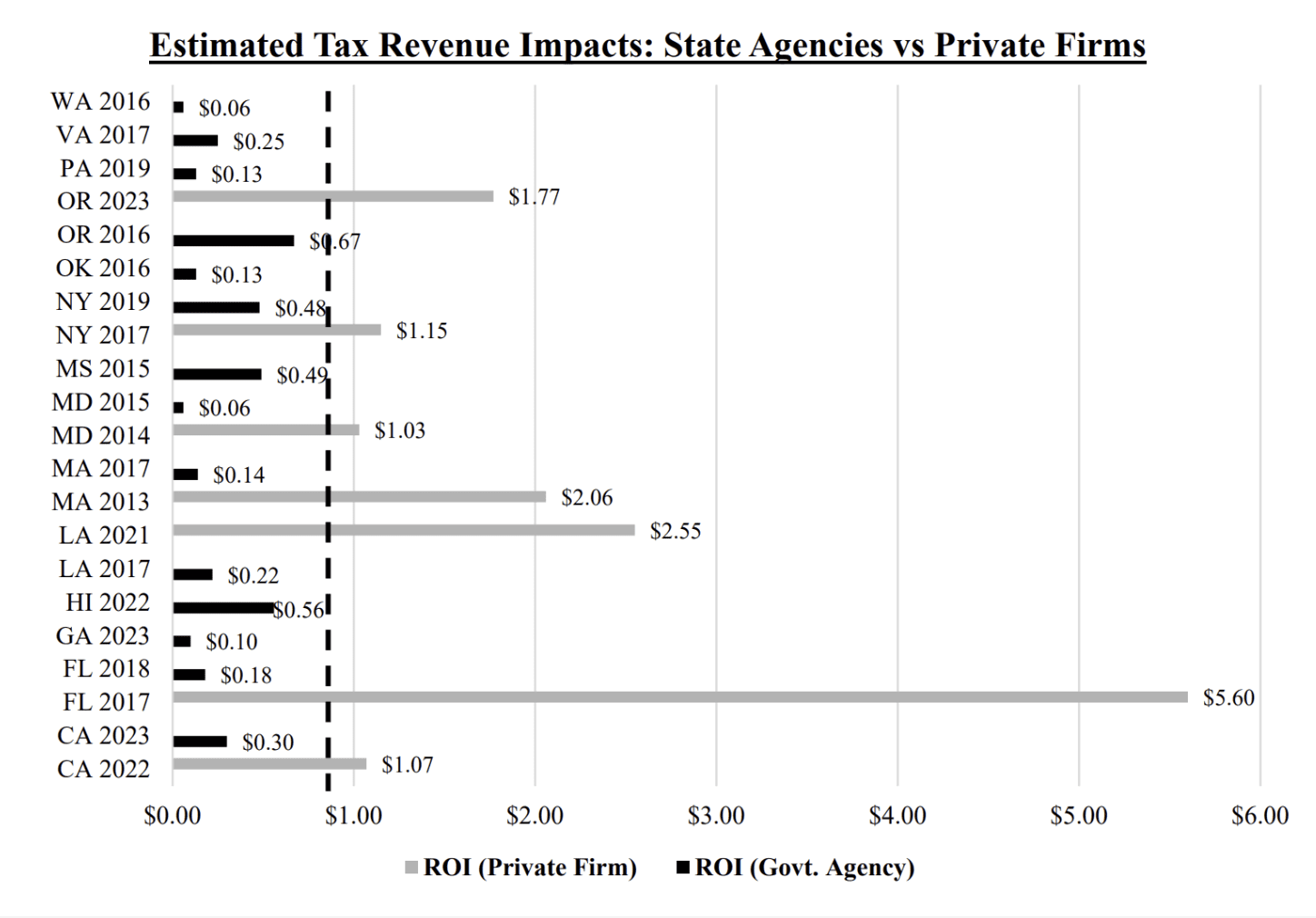

Supporters, including construction unions and higher education officials, hail the proposed incentives as an investment in Nevada’s creative future. But what looks like an economic spark on paper often fades under scrutiny. The gap between private projections and public audits isn’t an accident, rather it’s rooted in what those studies choose to count.

Private consultants hired by studios or local development groups typically tally every dollar spent in-state—hotel rooms, catering, truck rentals—as “new” activity, even when much of it replaces existing business or is spent on out-of-state labor. They also apply generous multipliers, assuming each dollar circulates several times through the local economy. Government auditors, by contrast, measure net impact—what remains once the subsidies are paid out and leakages are accounted for. That’s why Georgia’s and California’s official returns hover around twenty cents for every public dollar spent, despite billion-dollar production volumes.

The Transferable Credit Trap

The problem gets even deeper when incentives are transferable. Studios that don’t owe state taxes can sell their credits to other corporations, often giant corporate counterparts, at a discount. Those buyers then use the credits to offset their own tax bills, turning a film subsidy into a form of tradable income. In practice, this transforms reliable state revenue into a private arbitrage market, where profits are generated not through production or innovation, but through tax maneuvering.

Nevada Should Welcome Film Production—Not Pay for It

For Nevada, that means fewer public dollars for schools and infrastructure in exchange for temporary and limited jobs. Furthermore, as the entertainment industry shifts toward digital and AI-driven production, massive studio complexes look less like forward-thinking investments and more expensive monuments to a business model already in decline.

When the dust settles, the numbers tell a familiar story: Nevada has every reason to roll out the red carpet for film production—but not to fund it.

See How Your Lawmakers Voted on Film Tax Credits

Want to know which legislators stood up for taxpayers—and which ones backed costly Hollywood subsidies? Download Nevada Policy’s 2025 Legislative Scorecard to see the full voting record, explore the history of film tax credits in this session, and learn where your representatives really stand on fiscal responsibility.