Note: This is the first in a three-part series examining the Nevada Public Employees’ Retirement System, or PERS.

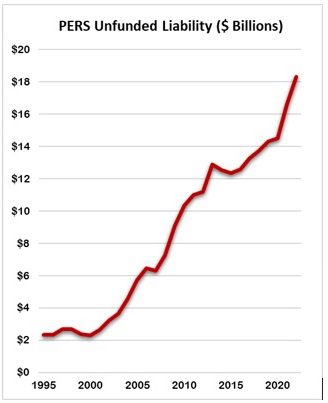

Taxpayers and public employees are once again going to have to pay more to bail out Nevada’s badly underfunded Public Employees’ Retirement System (PERS), after the system’s recent announcement that its debt now stands at an all-time high of $18.3 billion.

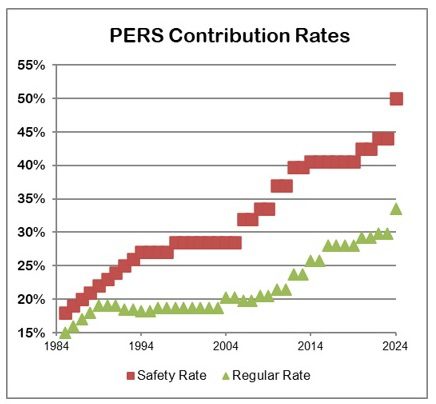

The relentless growth of PERS debt means yet another rate hike for Nevada public employees — most of whom are now paying the highest PERS rates in the nation.

PERS consists of two separate plans: one for police and fire members (the safety plan); and one for everyone else (the regular plan).

The annual contribution rates for safety plan members will rise to 50 percent in July — which means taxpayers must send PERS an additional 50 cents for every $1 in salary paid to police officers and firefighters. The contribution rate for regular plan members, which includes teachers, will rise to 33.5 percent of salary.

PERS costs are split evenly between taxpayers and the employee, with the employee typically paying their half through an equivalent salary reduction. This means that regular plan members, which include teachers, will see their paychecks reduced by nearly 17 percent annually starting this July — a rate that is higher than what any other group of comparable public employees nationwide pays for their respective PERS plan.

PERS costs are split evenly between taxpayers and the employee, with the employee typically paying their half through an equivalent salary reduction. This means that regular plan members, which include teachers, will see their paychecks reduced by nearly 17 percent annually starting this July — a rate that is higher than what any other group of comparable public employees nationwide pays for their respective PERS plan.

Unfortunately, these record-high contributions will not be enough to stop PERS’s debt from continuing to grow, according to the system’s just-released actuarial report.

Indeed, PERS’s actuary had determined that much larger rate increases are needed (37.5 percent for regular plan members and 57.5 percent for safety members), but the PERS Board directed the actuary to “phase-in” the necessary cost increase incrementally over four years, rather than all at once. But there is a cost to delaying the implementation of the necessary contribution rate increases — more debt, and thus a greater likelihood of future rate hikes.

PERS is becoming increasingly cash-flow negative as well. Last year, the system paid out $1 billion more than what it took in via contributions. Negative cash-flow makes it harder for the system to become solvent, even when investments perform as expected. As this situation worsens, it will create additional pressure to raise contribution rates.

In addition to the “phase-in” process outlined above, PERS also sought to delay the need for further rate hikes by consolidating its outstanding debt and then extending its debt repayment timeline. But as their actuary explains, this will increase “the total amount of interest” PERS must ultimately pay, which will require higher contribution rates in “the later years of the 20-year [repayment period].”

In other words, PERS members can expect further rate increases in the coming years.

In other words, PERS members can expect further rate increases in the coming years.

An important question some are asking is what do public employees get in return for their national-high PERS costs?

This latest rate hike, like the several that preceded it, will provide no benefit whatsoever to the current employees and taxpayers forced to pay this record-high cost, which instead will be used to bail out the System’s past funding failures.

Debt costs have grown so large, in fact, that they now account for half of regular plan members’ total 33.5 percent contribution rate. In other words, only 50 cents of every dollar that employers and current plan members send to PERS is used for the employee’s own benefit.

Unsurprisingly, this means that almost all current employees are expected to be “net losers” — meaning that they will have paid more into PERS than what they can expect to receive back in future benefits.

Further compounding this inequity are a pair of benefit reductions that have left regular plan members with much less generous benefits than those received by veteran employees.

In other words, the burden of paying down PERS soaring debt has made all parties worse off. New teachers are being forced to pay more, while getting less, as employers struggle to attract qualified applicants with such an unappealing retirement plan.

We will discuss this phenomenon in more detail in Part 2 of this series. Stay tuned!